It was nearing midnight on June 30, 2009. In the president’s office in Parkhurst Hall, Jim Yong Kim was having a reflective moment. The next day he would become only the 17th man to lead Dartmouth in its 240-year history. He surveyed the room, cleared and ready for him, but not yet made his: A computer sat on an otherwise bare desk, a row of bookshelves empty along the wall. Kim stood in front of the fireplace with a big smile on his face, feeling the awe of both the opportunity and the responsibility ahead.

By his side that late evening was Steve Kadish, Dartmouth’s newly hired senior vice president and strategic advisor, who had worked for Kim as chief operating officer at Brigham and Women’s Hospital, which is affiliated with Harvard Medical School. Earlier that year in Boston Kadish had watched Kim’s enthusiasm for Dartmouth build through the interview process. “I remember he came back from one meeting with the search committee quoting John Sloan Dickey: ‘The world’s troubles are your troubles…and there is nothing wrong with the world that better human beings cannot fix,’ ” says Kadish. “He was on fire with the idea of what this opportunity would be.”

What neither of them anticipated on that June evening was just how unusual the coming year would be—more specifically, how much it would focus on one thing: the budget. Kim had imagined he would ease into his new role, getting to know Dartmouth before making any big changes. Instead, his first year would be consumed by financial constructs he barely understood at the time: structural gaps, smoothing formulas and endowment distributions, ultimately leading to major cost-cutting and restructuring. Instead of pleasant “get to know you” gatherings, many in the community would meet him through emotionally charged forums on the budget, town hall meetings and protests.

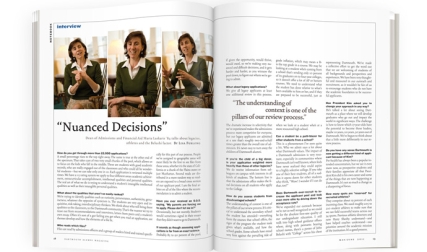

Although the sense of unease about budget cuts has died down considerably around campus, the budget review kicked off in 2009 continues to shape Dartmouth in profound ways. Last summer, as administrators began tackling a massive structural deficit, DAM initiated a series of interviews with Kim and other campus leaders to provide a behind-the-scenes look at how Dartmouth got through the budget crisis—and where the College goes from here.

By the time Kim took office most hoped that the worst of the 2008 financial downturn had blown through Hanover. Yes, the endowment had fallen from a high of $3.76 billion to $2.82 billion, but then-President Jim Wright had already taken decisive action, cutting $70 million from the budget and eliminating 60 jobs. Though publicly they made clear that further cuts might be necessary, privately Wright and the board of trustees also hoped they had bought Kim some breathing room.

“The objective during Jim Wright’s tenure was to try to give his successor some time to do his or her own analysis, knowing there would probably be more to do,” says Ed Haldeman ’70, the CEO of Freddie Mac who served as Dartmouth’s chairman of the board of trustees from 2007 until last June.

The analysis began right away, led by Kadish, who was no stranger to restructuring the financials of a large organization. As the undersecretary for the Massachusetts Department of Health and Human Services from 2003 to 2006, he had been deeply involved in a major restructuring of the $10-billion-plus department. Kadish had also been involved in the 1999 to 2002 turnaround of Harvard Pilgrim Health Care, helping it go from receivership (the nonprofit equivalent of bankruptcy) to profitability in short order. Kim describes him as “one of the most brilliant budget analysts I’ve ever met.”

Among those helping Kadish was David Spalding ’76, then VP of alumni relations and now Kim’s chief of staff. A 29-year veteran of Wall Street with an M.B.A. from New York University, Spalding had worked for Chase Manhattan, First National Bank of Chicago, GE Capital Corporate Finance Group and Lehman Brothers before becoming a founding partner of the Cyprus Group, a private equity firm.

For his part, Kim was getting up to speed on financials—period. “When I started I didn’t know what private equity was,” says Kim. “I didn’t know the difference between private equity and a hedge fund. I just had a very vague sense of all that stuff.” To remedy that, trustee Bill Helman ’80, now chairman of the trustee investment committee and a partner at the venture capital firm Greylock, drove up from Boston to give Kim a crash course in finance.

Kadish and his team pored over data and asked a lot of questions. The good news, he quickly found, was that the endowment had been well managed. Despite a -19.6-percent investment return in the fiscal year (FY) ending June 30, 2009, the negative returns compared favorably with most peer institutions. And the 10-year average endowment return for the fiscal years from 2000 to 2009 was still at 8 percent, putting Dartmouth in the top 5 percent of university endowments nationally. (Now looking at the period 2001-10, which excludes a 46 percent return in FY 2000, Dartmouth’s 10-year return averages 5.1 percent, placing it within the top 20 percent of universities.)

“Some of the answers I got were disconcerting in terms of what they meant,” says Kadish. Fundamentally, Dartmouth was spending more than it was earning, and that gap was forecast to grow. Just as disconcerting was that the inherited budget was built on an assumption that the endowment would continue to grow 10 percent annually.

“Before the fall of 2008, 10 percent returns made sense,” says Spalding. After all, returns had exceeded 10 percent for the previous four years, reaching 23.7 percent in FY 2007. “But in the fall of 2009—coming off the worst year by far in recent memory and a 10-year average performance of 8 percent—it was hard to feel comfortable building a budget off those numbers,” he says.

Also unsettling was the fact that Dartmouth’s endowment distribution—the percentage of the endowment the College spends each year—was 7 percent, well above the traditional best practice of 4.5 to 5 percent. If the economy took another dive—an entirely plausible scenario, and one that Kim says he still thinks about today—Dartmouth could be facing even tougher choices.

The analysis yielded numbers that made everyone in the Kim administration gulp: If they did nothing Dartmouth would be running a deficit of about $100 million within two years.

As the fiscal crisis played out, life in Parkhurst became synchronized to the rhythm of board of trustees meetings, pizza deliveries, late-night surges in electricity use and individual sleep deficits peaking just prior.

The first meeting was a doozy for Kim, both exhilarating and sobering. On September 22, 2009, he would give his first major public address at Convocation, receive the Wentworth Bowl and officially be inaugurated as the president. The day before, the man who three months prior was fuzzy on the difference between public and private equity would stand up in front of some of the nation’s best business minds, trustees such as General Electric chairman and CEO Jeff Immelt ’78 and eBay president and CEO John Donahoe ’82, and explain to the board why the current endowment distribution was unsustainable in light of the economy. Emphasizing that all cuts would have to be strategic in order to preserve the academic experience of Dartmouth, Kim made clear the amount to be trimmed from the budget was in the neighborhood of $100 million. The board agreed.

After briefing the Faculty Committee on Priorities, Kim spelled things out clearly in an October 9, 2009, memo to faculty and staff: “First, we will reduce expenses.” It set off a firestorm of speculation and worry that hundreds of layoffs were imminent.

Having wrapped their arms around the problem for the September board of trustees meeting, Kim and his team now had until the November 5, 2009, meeting to propose a timetable and strategy for making those cuts.

The financial crisis was not unique to Dartmouth, of course. Many peer institutions chose to make budget cuts but continue to reduce their endowment expenditures slowly. For Kim, this strategy was doubly worrisome. Not only could Dartmouth face painful and undesirable financial scenarios if the economy took another dive, but a gradual reduction would mean slow but steady contraction of the endowment payouts for many years to come.

Instead, Kim homed in on a strategy put forth by Stanford University President John Hennessey: Make cuts as quickly as possible, painful as that may be, and then instead of dying the death of a thousand cuts you can begin to invest in growth. “That just made a ton of sense to me,” says Kim. “If the economy gets worse, then you’ve done a lot of important work. But if the economy improves, then you’re ready to really think about strategic planning rather than continuing to think about more and more cuts.”

After producing and refining the financial models, Kadish and his team recommended a two-year horizon, reducing the budget each year by $50 million. “Jim was hoping we could get there in one year, but it wasn’t feasible,” says Kadish.

Although they considered bringing in consulting firms including Deloitte to lead the reduction process, eyes bulged at the proposed multimillion-dollar price tags as bids came in. Instead, Kim decided to hire away one of Deloitte’s consultants, Antonia Jimenez, and use her insight on processes to work with the talent Dartmouth already had. (Kadish had worked with Jimenez twice previously, at Harvard Pilgrim and again in the Massachusetts state government.)

Kim dramatically expanded the budget committee, a group that had long met to provide advice and counsel to the president on budget matters. In October 2009 he tapped Kadish and then Dean of the Faculty Carol Folt (who has since become Dartmouth’s provost) to lead it. They increased its membership from 20 to 33, bringing in the deans and chief financial officers from the professional schools as well as additional faculty from the College of Arts and Sciences, and began to meet, often on a weekly basis. The group turned its regular meeting space, 303 Parkhurst, into a hastily modernized power strip- and whiteboard-filled war room.

At the November board meeting the trustees spent hours debating the pros and cons of quick cuts vs. spreading them out over time. The argument for the slow route was that by spreading out cuts and layoffs gradually, the negative impact on campus would be lessened. “But as we talked Jim increasingly caused the board to see that it would be better for the institution to take the reductions at one time and then be able to go back to the phase of creating new programs, new experiences, growing again,” says Haldeman.

According to Kim, the board was also concerned about the impact swift cuts would have on his relationship with the Dartmouth community. “I think financially everyone felt it was the right thing to do,” says Kim of quick cuts. “They just worried that we wouldn’t survive the political fallout.”

Kim had experienced the heat of protest before, notably in 2004, when as director of the World Health Organization’s HIV/AIDS department he led an initiative aimed at getting 3 million people in developing countries on AIDS treatment by 2005. “There were days the BBC would light up with very critical stuff, sometimes directed at me personally, and I would walk into the office just feeling so bad, like I wanted to crawl into a hole,” says Kim. “But after a few days these things pass. What I understood from that experience is that if it’s the right thing to do, you just have to do it.”

Listen to or read enough of the administration’s budget reduction messaging and you will be clobbered over the head with the word “strategic.” Never just cuts, strategic cuts made by the Strategic Budget Reduction Initiative (SBRI)—not done across the board, mind you, but strategically. The implication to nervous College alumni and observers: Don’t worry, we’re not going to harm the “Dartmouth experience.”

Although hiring was delayed on more than a dozen vacant faculty positions, no faculty were laid off, and student academics went largely unchanged, though some course offerings were reduced.

“The most valuable experience that the students have is when they’re working intensively on projects with individual faculty members,” says Kim. “You can call that inefficient, but I would call that high value. What do we need to do to be able to create more experiences like that? I think what we need to do is to free up money from the administrative side so that we can invest more in the educational side.”

The real secret sauce to the SBRI was in the horizontal cuts, the streamlining of campuswide administrative areas such as benefits, IT, procurement and finance. This type of restructuring and belt-tightening is commonplace in business, but almost unheard of in higher education, according to Kim’s team.

As Kadish and Jimenez examined Dartmouth’s administrative systems, it was clear that inefficiencies were complicating what should be simple tasks. As they mapped each transaction, creating mind-bogglingly complex flow charts, they were surprised to see how many shadow systems existed for any given transaction. “There were tracking systems to track other departments doing their systems,” says Jimenez, “If someone lost a paper once, a system was created to prevent that problem from recurring.”

In other cases policies were inconsistent from one part of Dartmouth to another, which created confusion and led to errors. For example, one department’s travel policy required receipts for expenses of $75 and up, another for $50 and up, and a third for anything greater than $1.

“There are 3,056 staff at Dartmouth, of whom 300 or 400 touch our financial processes,” says Kadish, whose title changed to executive vice president and chief financial officer in June 2010 as part of an administrative reorganization. “Some people only do a particular transaction once or twice a month, which makes them more likely to get it wrong.”

By creating five new financial centers to centralize tasks such as processing a new hire, issuing reimbursement for travel expenses or purchasing supplies, the goal is for Dartmouth’s financial transactions to become faster, more efficient and easier to track. Two centers have already been established with three more to come.

Procurement, too, had become fragmented. The team’s analysis showed that the Dartmouth faculty and staff of 4,060 had been ordering 703 different types of pens and 204 varieties of sticky notes. The amount Kadish’s team estimated would meet 90 percent of the need? Ten pens and three sticky notes.

Kadish is quick to absolve anyone from blame for past inefficiencies, noting that it’s normal for businesses to develop this way, individuals creating systems to solve their teams’ problems. “I always say it’s good people trying to make the best decision with the information they have,” says Kadish. The SBRI, he believes, offers a once-in-a-generation opportunity to organize, streamline and declutter.

“I hope that we develop ways of running Dartmouth that are more effective and less expensive and that every year we do it even better,” says Kim. “My guess is if we do that not only will we have lowered our costs, but everyone will be experiencing the new administrative structure as more effective and better.”

All in all Kim’s first year was challenging for everyone on campus. If there’s any silver lining, says Spalding, it’s that Kim was able to fundamentally shape Dartmouth faster than anyone would have expected. “Normally presidents shape an institution by looking at how to increase spending,” says Spalding. “Kim had to do it through cutting.”

Imagine for a moment your typical finance guy, the kind of hard-charger you bring in when you need to hack out tens of millions from your organization’s budget in short order. Got it? Now picture the opposite. That’s Steve Kadish.

Kadish speaks in soft, gentle tones. He specializes in the contemplative pause, making you feel how unconsidered and imprecise your thoughts are by comparison. “In one of the early budget committee meetings, Steve said something like, ‘Let’s all remember to be hard on ideas, but soft on people,’ ” says Sylvia Spears, acting dean of the College. “He’s a very calm presence.”

In many ways Kadish is a complementary counterpart to both Folt and Kim. Folt buzzes with energy. When she speaks of bringing faculty voices into the budget process, you can almost imagine her cheerfully rallying the faculty to meetings. A member of the faculty since 1983, she holds institutional knowledge that is valuable to the new administration.

By his own admission, Kadish is a worrier. “I feel like one of my jobs is to worry, and by worrying about what can go wrong, figure out how to make that not happen,” he says. “Jim is much more about new ideas and creation. He has such optimism and I believe it’s that optimism that allowed him do things in global health that were previously unthinkable.” It’s as if Kadish worries so Kim doesn’t have to.

Kim was cautiously optimistic from the start that $100 million in cuts could be identified. Folt says she knew it was possible when she saw how well the faculty and staff collaborated in budget committee meetings. It took Kadish until Saturday, December 11, 2009.

It was during a call to Folt that day when the rough, back-of-the-envelope estimate of what they thought they could save without doing harm to Dartmouth finally topped $90 million. “I knew some of the numbers were off, but they were off by a order of magnitude that was tolerable,” says Kadish. “That was a great moment of confidence for me. It was enough to know that it was possible to do.”

But Kadish’s confidence hadn’t yet fully solidified when, on December 1, President Kim stood before a crowd in Alumni Hall in his green-and-navy striped tie and unveiled this plan to the Dartmouth community. Framing his speech around where Dartmouth will be at its 250th anniversary in 2019, Kim provided detailed financials, explaining the structural gap and his rationale for why the College needed to cut big and move fast.

At the end of that month Dartmouth reached a milestone seven years in the making, wrapping up the $1.3-billion Campaign for the Dartmouth Experience. But what should have been an achievement to celebrate now felt like a public relations liability.

Over and over in forums and private conversations, the administration was put on the defensive. “Why can’t you just close the gap with some of that $1.3 billion you just raised?”

Before the din could grow louder, on January 15, 2010, Kim and his team held another Alumni Hall forum in which Carrie Pelzel, then-VP for development and now senior VP for advancement, offered an explanation. The College couldn’t use that $1.3 billion to cover the structural gap, she told the capacity crowd, because one portion of it had been earmarked for current use expenses and was already spent, another portion was committed to specific building projects either done or in progress, and the final portion was gifts to the endowment for specific purposes such as new professorships. She also noted that some of those funds were currently under water.

Although that largely diffused the question, the type of gala celebration that has accompanied previous campaign conclusions was intentionally tabled. The only celebration was a quick dessert-only reception, held in conjunction with a philanthropic investors’ meeting in New York City, to thank the 20 members of the campaign’s executive committee. “Given the kind of cuts we had to make,” says Pelzel, “it was just totally inappropriate for us to do anything but that.”

Between the November 2009 and February 2010 board of trustee meetings, the budget committee’s goal was to identify $100 million in savings—$50 million from FY 2011 and another $50 million from FY 2012.

It was during this time that members of the budget committee sat down individually with Kim and his team and made PowerPoint presentations about their respective areas. They also heard presentations on proposed horizontal cuts. “It was almost like Neo in The Matrix,” says Spalding. “Kim was sitting at the head of the long conference table in his office, downloading everything there was to know about facilities or athletics or admissions—asking questions, pushing back.”

One particularly painful and unpopular decision was backing off of the 2008 commitment to no-loan financial aid packages for undergraduates. Reinstating loans for families earning more than $75,000 would save Dartmouth $10 million once fully implemented for all four classes, but how would it impact students? Dean of Admissions and Financial Aid Maria Laskaris ’84 and her team crunched the numbers and determined that even with loans returned to the financial aid mix, no student would graduate with more than $22,000 in loan debt. Kim, who graduated from Brown in 1983 with $40,000 in loans, thought it was an acceptable burden.

But would it leave Dartmouth unable to compete for top students? Laskaris determined that only 60 or 70 of the 2,100-plus students admitted annually were also accepted by other schools with no-loan policies. “We thought for those 60 or 70 students, we can always match [other schools’ offers],” says Kim.

Not every proposed change was adopted. One of the most publicly discussed, an unpaid furlough for employees that would take place around the December holidays, was studied and rejected. While the staff salary savings would have been significant, some staff would still be needed to keep facilities maintained and laboratory research operating. Campus leaders also worried about the College’s lowest-paid workers losing a paycheck, especially around the holidays. And while many College buildings could be shut down to save heating and electricity costs, others could not. Although a furlough would have saved an estimated $1.5 to $2 million, Kim and the budget committee decided that the savings were not worth the negative impacts it would have.

In looking for areas where Dartmouth could achieve big savings quickly, its annual healthcare bill—$44 million in FY 2009, up from $28 million just three years earlier—was an obvious choice. “It had been almost 20 years since we made significant changes,” says former chief human resources officer Traci Nordberg, who has since left for a position at Vanderbilt University. Though Dartmouth’s benefits council, a committee of faculty and staff, was in place to examine regularly the College’s benefits, in the past Nordberg says it had primarily been looking at additions rather than subtractions.

Dartmouth’s health insurance plans were “by far the most generous of any of our peers,” says Kim, basing the claim on a 2009 Hewitt Consulting report that compared health plan features and costs at 60 colleges and universities. Under the most popular plan now being offered, there is an individual deductible of $250 ($500 for two and $750 for a family) with 10 percent co-insurance. In addition, employees now shoulder a higher percentage of the cost of their premiums, now paying 25 percent, up from 20 percent. (The split for any staff member is on a sliding scale based on income; those who make $20,000 pay nothing and those making more than $200,000 pay 38 percent.) Another benefit cut came when it was decided to discontinue a 7-percent salary payment to new staff hires over the age of 40. The benefit stays in place for existing staff and faculty, as well as any new faculty hires.

By re-bidding contracts, director of facilities Linda Snyder (who is also Steve Kadish’s wife) was able to reduce the budget of the new Visual Arts Center by $10 million, largely by seeking competitive bids for different aspects of construction.

In one particularly creative move a $12-million gift from the class of 1953, designated to construct a new cafeteria in the McLaughlin Cluster on the north end of campus, was instead used to renovate Thayer Hall into the renamed Class of 1953 Commons.

The gift, given in 2003, had been in a holding pattern as Dartmouth first tackled other new building priorities. It was kept on the hold list after building estimates came in more than double the gift amount. In good times Dartmouth could take on the balance as debt. But these were not good times. “These wonderful alumni in the class of 1953 wanted to see this done,” says Pelzel. “A number of them called and said, ‘You know, we’re not getting any younger. We’d love to see this built while we’re still alive.’ ”

At the same time, Thayer was in need of renovation. Its mechanical systems were so inefficient they were heating the air around the building in the wintertime. Snyder’s team realized that the class of 1953 gift, combined with cost savings derived from greening the building, could meet both priorities.

Immediately after the board approved these changes at its February 2010 meeting, the changes to financial aid were announced, along with the stickiest wicket by far: layoffs.

Layoffs were a core issue for Students Stand With Staff, a student organization formed in January 2010 to advocate for the fair treatment of College staff during the budget crisis. On the afternoon of February 4, 2010, not long before they held an evening vigil with union workers on the Green with more than 400 attendees, at least a dozen students met with Kim, Kadish and Nordberg in Kim’s office. By all accounts, it was a contentious meeting.

Group organizer Eric Schildge ’10 describes Kim during that meeting as angry, defensive and patronizing. The students present wouldn’t have been surprised to be “patted on the head and shooed out the door,” says Schildge. Instead they were surprised by the “tongue lashing” Kim gave them.

Phoebe Gardener ’11, another organizer who was at the meeting, acknowledges that the students’ written list of demands was partly to blame for the tense mood, but was disappointed in Kim’s reaction. “Instead of embracing us as students concerned about social justice he treated us as if we didn’t have enough information to understand the issues, that it wasn’t our business and we were not financially aware enough,” she says.

Kim is quick to express regret about the tone of that meeting. What the students heard, he says, “was my frustration at the demands they were making that didn’t seem to reflect the communications that were out there. It was a moment of great frustration for me.” Shortly thereafter Kim met again with Schildge and another student. Schildge describes Kim’s tone in the meeting as “apologetic.”

“I expressed to them that I was very proud that they did what they did and that it was a moment of great courage,” says Kim. “They were making a principled stand and that was exactly what I would have them do. It’s not easy for someone who has worked for social justice his whole life to be picketed around the issue of social justice. It was not an easy thing for me to deal with personally.”

When the announcement of layoffs came on February 8, 2010, it was not as bad as many feared: 38 employees were let go, with two more added later. Kim says that he made sure to read the name of every person who was laid off. “I was later heartened by the fact that many of them were losing their jobs in areas where we’ve rehired people very quickly,” he says. “The fact that many of them had a great chance of being rehired was encouraging to me.”

Of the 100 who were laid off between Wright and Kim’s tenures, 22 have been hired back, the majority of those in jobs at Dartmouth Medical School. (Some of the others have already accepted jobs elsewhere, according to Nordberg.)

More than 100 voluntary early retirements or layoffs—sweetened by the December 2009 offer of nine months of severance, up from six—reduced the need for some involuntary layoffs, each of which averaged $70,000 in annual savings to the College.

Nonetheless, the specter of layoffs during a prolonged period was stressful for staff. All staff and faculty salaries were frozen in FY 2010. In FY 2011 staff received an across-the-board 1 percent raise; faculty received 3 percent. The professional schools also had a pool of money equal to 1 percent of staff salaries to distribute at their discretion as merit raises.

In the end the staff raise proved a de facto reduction for roughly half, whose 1 percent raise was eclipsed by the increase in health insurance premiums that began in January 2010, resulting in a decreased or near-flat amount of take-home pay. The administration’s implication has been that staff didn’t mind the cutbacks because the alternative was layoffs. But quietly, many were frustrated.

“Of course we mind [the pay freeze],” exclaims one staff member who asked to remain anonymous. “Nobody wants layoffs, but at the same time, our salaries haven’t gone up. People are not happy about it.” Other staff report that many of their colleagues share a simmering resentment and frustration that they bore the brunt of the cutbacks while the faculty went untouched. In that context, objectively small changes such as raising annual parking fees from $6 to $12 per month for non-exempt and hourly workers and from $10 to $30 a month for exempt and salaried workers—which increases revenue by $400,000 annually—have raised the blood pressure of more than a few. “How many people do you know who have to pay for parking at their job?” asks one staffer.

By the fall 2010 the SBRI had pinned down $83 million of the needed $100 million, and the bulk of its energy had shifted from discovery to execution, an important if somewhat less dramatic process of project management and business process design.

The first year of an exercise such as this is oddly straightforward, says Kadish, in that it’s a process of examining the numbers and making a plan. The second year, he says, is harder as it deals with more of the cross-institutional issues and seeks to sustain momentum. “After the first year some people feel like, ‘We did it! Now we can go back to the way we used to do things,’ ” he says. “The second year is about maintaining the culture of continuous improvement you’re trying to build.”

Continuous improvement, however, doesn’t come without controversy. According to an October 19, 2010, article in The Dartmouth, several administrators expressed frustration with the new Ricoh copy machines mandated by procurement, complaining—largely anonymously—that the machines were slower and lacked some of the features of the previous models.

“To be honest, it was a very bumpy rollout,” admits Kadish. “About 80 percent went smoothly, but parts of it happened too quickly. We had a team of 12 Ricoh employees here for a couple of months and we went through everybody’s issues. We really feel as though that’s behind us and we learned a lot about communicating and responding.”

In addition, Service Employees International Union (SEIU) Local 560 filed a grievance with the College, claiming unfair labor practices regarding the introduction of W.B. Mason as the sole vendor for office supplies. The union doesn’t object to W.B. Mason as a vendor, but union employees previously had delivered supplies from a warehouse in nearby Lebanon, New Hampshire; now W.B. Mason delivers supplies directly to College offices.

“By subcontracting out our work, we’re losing work, which is an unfair labor practice,” SEIU President Earl Sweet told The Dartmouth in October 2010. “It’s very concerning to us that they keep subcontracting out our jobs, because we all eventually might not have jobs.”

The union has filed several other grievances against the College. When management of the Hanover Inn was outsourced to Pyramid Hotel Group in August 2010 union employees retained their jobs at the same wages but, Sweet says, with greatly reduced benefits. In addition, union employees at Dartmouth Medical School’s Café North were reassigned when the College closed it in June 2009. Despite giving the union repeated assurances that Café North would not reopen, says Sweet, the College has given a local bagel shop use of the space, in effect subcontracting jobs, as was done at the Inn.

From the beginning of the budget crisis Sweet and the union have been Kim’s most vocal critics. Although no union members have been fired or laid off, according to Sweet, 114 union jobs have been lost through retirement and are not being filled. (There are now approximately 400 union workers employed at the College and another 50 at the Hanover Inn.) Sweet understands the need for budget cuts, but he says it feels as though Kim and his team have used the budget crisis as an opportunity to reorganize and eliminate jobs in a way that was not transparent. “In many ways the nonunion employees have it worse than we do,” says Sweet. “We can speak up. They are afraid to.

“I could talk to President Wright,” says Sweet. “President Kim is not that open.” However, Sweet admits he has not requested time to meet with Kim. When asked in January to respond, Kim noted, “I would happily meet with Earl Sweet anytime he wants to meet with me.”

Recently news on the endowment has been positive. The value of the endowment is up to $2.99 billion. The 10 percent returns that the administration did not want to depend on back in 2009 did in fact transpire for FY 2010 [ending June 30]. Those gains reduced by about $3 million the amount Kadish and his team needed to cut from the budget. However, Kadish notes that going forward the vast majority of endowment returns that exceed projections will be put into strategic reserves and not credited to any budget cuts.

A plan to close the full $100 million gap through FY 2012 was presented to the board of trustees in April. The normal rates of hiring and letting go have resumed; barring another financial downturn, there will not be any focused program of layoffs.

From his office—now filled with books and decorated with a statue of Daniel Webster (class of 1801), a drawing of Samson Occom and a mosaic of the 16 previous College presidents—Kim is excited about returning to the phase of leadership where he can influence Dartmouth by addition rather than subtraction.

As he went through the interview process more than two years ago, Kim was electrified to learn about the job of a college president—an avocation he had never before considered. He was excited by the impact his position could have, as he puts it, “on students, on scholarship, on real problems that exist both in the Upper Valley of New Hampshire and Vermont and in the nation and the world.” Though that excitement was muted somewhat by the financial crisis, Kim admits the feeling has returned.

“We still have some things to do and adjustments to make,” he says, “but there’s no doubt we are fully into the phase of looking forward.”

Julie Sloane is a frequent contributor to DAM. A former writer for Fortune Small Business, she lives in Pennsylvania.